Employer matching contributions are a powerful incentive for retirement planning, encouraging employees to save through capital accumulation strategies. This involves employers contributing to employee retirement accounts when they make their own deposits, fostering long-term capital growth from small savings. Ultimately, it leads to robust retirement savings and enhanced financial security, while also benefiting businesses by supporting employee financial well-being, loyalty, and retention. A well-designed capital accumulation plan, including strategic investments and tax-advantaged accounts, is crucial for achieving both business success and prosperous futures for employees.

Employer matching contributions are a powerful tool that can significantly enhance retirement savings. Understanding how these contributions work is crucial for maximizing your wealth accumulation strategies. This article delves into the mechanics of employer matching and its profound impact on financial planning for growth and retirement security. We explore capital accumulation plans, strategies for business capital growth, and the role of long-term capital growth in ensuring a secure future.

- Understanding Employer Matching Contributions: A Key to Boosting Retirement Savings

- How Employer Matching Works and Its Impact on Your Wealth Accumulation Strategies

- Optimizing Your Capital Accumulation Plan: Strategies for Business Capital Growth

- The Role of Long-Term Capital Growth in Financial Planning for Growth and Retirement Security

Understanding Employer Matching Contributions: A Key to Boosting Retirement Savings

Employer matching contributions are a powerful incentive that plays a pivotal role in encouraging employees to save for retirement. This strategy, often an integral part of a comprehensive capital accumulation plan, involves employers contributing a specified amount to an employee’s retirement account when they make their own contributions. It’s essentially a form of financial planning for growth that leverages the power of long-term capital accumulation.

By offering matching contributions, businesses not only support their employees’ financial well-being but also foster a culture of wealth accumulation strategies. This simple yet effective investment accumulation plan ensures that even small amounts saved by employees are significantly enhanced by the employer’s contribution, ultimately leading to substantial retirement savings and long-term financial security.

How Employer Matching Works and Its Impact on Your Wealth Accumulation Strategies

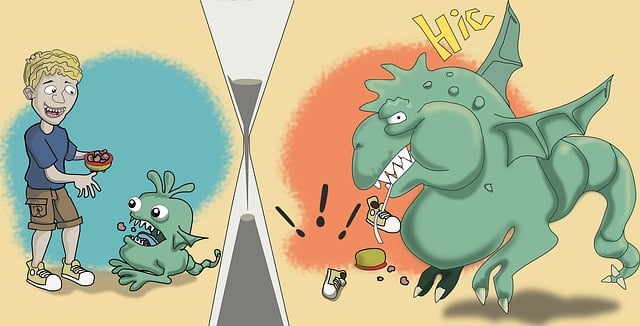

Employer matching contributions are a powerful tool in your wealth accumulation strategies, particularly when it comes to retirement savings plans. This incentive program works by encouraging employees to save for the future by matching a portion of their contributions to a business capital accumulation or investment accumulation plan. For instance, if an employee contributes $100 per month, the employer might match that with an additional $50, effectively doubling the funds available for long-term capital growth.

This dynamic significantly boosts financial planning for growth, as it essentially provides free money for employees’ investment portfolios. The impact is profound: over time, this can lead to substantial increases in savings and accelerate progress towards financial goals. Whether you’re looking to build a robust retirement nest egg or fund other significant investments, employer matching contributions offer a strategic advantage that should not be overlooked in your capital accumulation plan.

Optimizing Your Capital Accumulation Plan: Strategies for Business Capital Growth

Optimizing your capital accumulation plan is a strategic move that can significantly impact your business’s financial health and future prospects. A well-designed capital accumulation strategy not only aids in building wealth but also ensures a robust retirement savings plan for employees, fostering loyalty and retention. By integrating thoughtful financial planning for growth, businesses can enhance their competitive edge and ensure long-term capital growth.

Effective strategies involve identifying investment opportunities that align with the company’s goals and risk tolerance. Diversifying investments is key; this includes exploring various asset classes like stocks, bonds, and real estate to mitigate risks associated with a single market. Additionally, regular review and rebalancing of the accumulation plan are essential to adapt to changing economic landscapes. Leveraging tax-advantaged retirement accounts can also play a significant role in maximizing savings over the long term, contributing to a prosperous future for both business and employees alike.

The Role of Long-Term Capital Growth in Financial Planning for Growth and Retirement Security

In the realm of financial planning, particularly for businesses and individuals aiming for substantial growth and secure retirements, long-term capital growth plays a pivotal role. A robust capital accumulation plan or strategy is akin to laying the groundwork for a sturdy financial future. This involves carefully structuring investment accumulation plans that align with one’s financial goals and risk tolerance. By adopting effective wealth accumulation strategies, whether through direct investments, retirement savings plans, or employer matching contributions, individuals and businesses can foster substantial capital growth over time.

Such strategies enable steady wealth generation, enhancing the overall financial landscape for both business expansion and personal retirement security. The power of long-term capital growth lies in its ability to compound, creating a snowball effect that significantly increases accumulated capital. This, in turn, empowers individuals and businesses to navigate financial landscapes with confidence, ensuring they are well-prepared for future endeavors and life stages, from career advancement to comfortable retirements.

Employer matching contributions play a pivotal role in retirement planning by significantly enhancing one’s savings. By understanding how these contributions work and implementing effective capital accumulation strategies, individuals can optimize their financial future. Long-term capital growth is key to achieving both personal growth and secure retirement. Integrating employer matching into a robust investment accumulation plan allows for substantial wealth generation over time, ensuring a robust financial foundation for the years ahead.